Strategies for Enhancing Employee Engagement: Ways To Boost Employee Productivity In Business

Ways to boost employee productivity in business – Creating a culture of engagement among employees is essential for boosting productivity and ensuring job satisfaction. Engaged employees are more likely to go above and beyond in their roles, contributing positively to the workplace environment and overall business success.

Building a Culture of Engagement

To foster a sense of engagement, businesses can implement several strategies:

- Encourage open communication by creating platforms where employees can share ideas and feedback.

- Organize regular team-building activities that promote collaboration, such as retreats, workshops, or volunteer days.

- Incorporate a feedback system that actively invites employee input and makes them feel valued. This could include quarterly surveys or suggestion boxes.

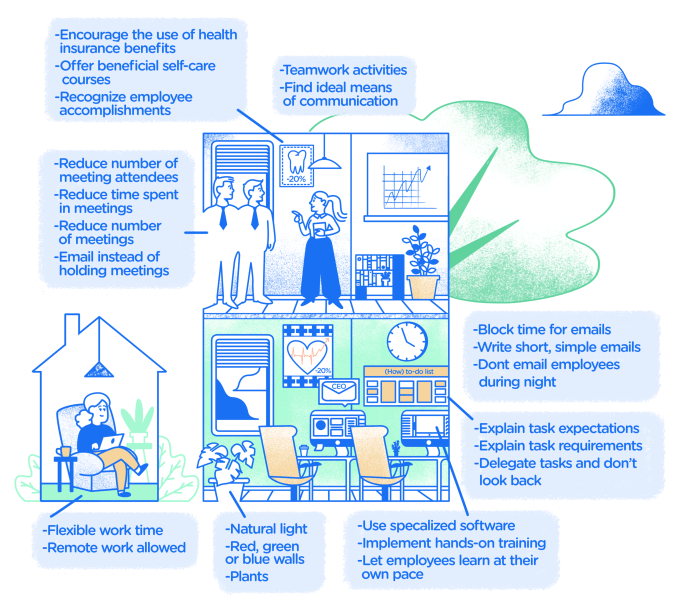

Implementing Flexible Work Schedules

Flexible work arrangements can significantly enhance productivity by allowing employees to work at times when they feel most effective. This adaptability can lead to increased job satisfaction and a healthier work-life balance.

Benefits of Flexible Work Arrangements, Ways to boost employee productivity in business

Organizations that embrace flexible work schedules often report high levels of employee productivity. Some examples include:

- Companies like GitHub and Basecamp have adopted remote work policies that allow employees to work from anywhere, resulting in enhanced job satisfaction and retention rates.

- Implementing staggered hours can help manage workloads during peak times while accommodating personal commitments.

Investing in Professional Development

Investing in professional development not only enhances employee skills but also boosts morale and motivation within the workplace. Companies that prioritize training and mentorship often see improved performance and reduced turnover.

Types of Training Programs

Organizations can offer various training programs to support employee growth:

- Technical skills training to keep employees updated on the latest tools and technologies relevant to their roles.

- Soft skills workshops focused on communication, teamwork, and leadership.

- Mentorship programs that pair less experienced employees with seasoned professionals, fostering knowledge transfer and professional relationships.

Utilizing Technology for Work Efficiency

Technology plays a crucial role in enhancing work efficiency by facilitating better communication and collaboration among teams. Leveraging the right tools can streamline processes and reduce the time spent on repetitive tasks.

Collaboration and Communication Tools

There are several tools available to boost team productivity:

- Platforms like Slack and Microsoft Teams allow for real-time communication and collaboration, enabling teams to stay connected regardless of location.

- Project management applications such as Trello and Asana help teams organize tasks, track progress, and manage deadlines effectively.

Creating a Positive Workplace Environment

A healthy workplace culture is vital for employee well-being and productivity. Elements that contribute to a positive environment include open communication, inclusivity, and support for mental health.

Wellness Programs

Implementing wellness programs can significantly enhance employee morale:

- Fitness challenges, yoga classes, or mindfulness sessions can help reduce stress and promote physical health.

- Offer mental health resources or counseling services to support employees in managing their mental well-being.

Setting Clear Goals and Expectations

Setting clear goals is essential for guiding employees and aligning their efforts with the company’s objectives. Well-defined expectations help employees prioritize their work effectively and focus on what matters most.

Aligning Team Objectives

To ensure everyone is on the same page:

- Establish SMART goals (Specific, Measurable, Achievable, Relevant, Time-bound) that provide clarity and direction.

- Regularly review and adjust goals to reflect any changes in business strategy or employee performance.

Recognizing and Rewarding Employee Achievements

Recognizing and rewarding employee achievements plays a crucial role in maintaining motivation and boosting morale. Effective recognition programs can lead to heightened productivity and employee satisfaction.

Incentives and Non-Monetary Rewards

Companies can implement various recognition strategies:

- Public acknowledgment of achievements during team meetings can reinforce positive behaviors.

- Offering non-monetary rewards, such as extra time off, flexible working hours, or personalized thank-you notes, can create a supportive atmosphere.

Enhancing Work-Life Balance

Supporting employees in achieving a healthy work-life balance can lead to lower stress levels and greater job satisfaction. Companies that prioritize this balance often see increased productivity and retention.

Approaches to Support Work-Life Balance

To help employees manage their workloads effectively:

- Encourage regular breaks and time off to recharge, especially during high-stress periods.

- Implement policies that allow for remote work options and flexible scheduling to accommodate personal needs.