How to Manage Cash Flow Effectively

Managing cash flow is crucial for the success of any business, big or small. Cash flow represents the movement of money in and out of your business, impacting day-to-day operations and long-term planning. Understanding how to manage cash flow effectively enables businesses to maintain liquidity, meet financial obligations, and make strategic decisions for growth. This article will guide you through essential aspects of cash flow management, from understanding the concept to leveraging financing options.

Understanding Cash Flow

Cash flow is the net amount of cash being transferred into and out of a business. It is vital because it indicates the financial health of a company. A positive cash flow means that a business has more money coming in than going out, allowing it to settle debts, reinvest, and grow. Conversely, negative cash flow occurs when expenses exceed income, which can lead to financial distress.Common sources of cash flow include:

- Sales revenue from goods and services.

- Loans and financing options.

- Investments and interest income.

On the other hand, cash flow uses may involve:

- Operating expenses such as salaries and rent.

- Purchase of inventory or equipment.

- Loan repayments and interest payments.

Assessing Cash Flow

Tracking cash inflows and outflows is essential for effective cash flow management. Various methods can be used, such as maintaining a cash flow statement that Artikels the financial position of the business. A cash flow statement typically includes three parts: operating activities, investing activities, and financing activities.Tools and software like QuickBooks, Xero, and CashFlow Manager can simplify the process of tracking cash flow.

These platforms automate data entry and provide real-time insights, making it easier to manage cash flow effectively.

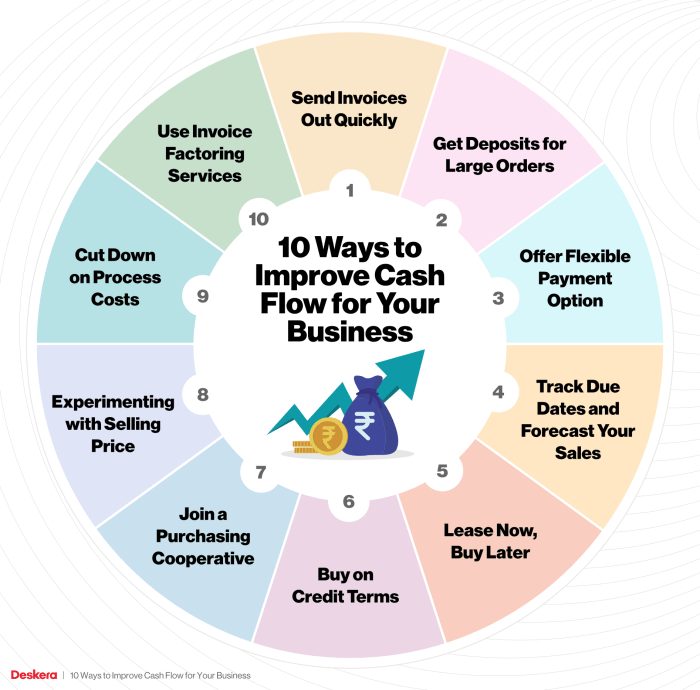

Improving Cash Flow

To enhance cash flow, businesses can employ several strategies. Accelerating cash inflows can be achieved by:

- Offering discounts for early payments.

- Implementing streamlined invoicing processes.

- Utilizing electronic payment options for faster transactions.

Managing cash outflows involves:

- Negotiate better payment terms with suppliers.

- Prioritize essential expenditures.

- Consider leasing instead of purchasing equipment.

Regularly reviewing expenses and adjusting operational strategies can significantly improve overall cash flow health.

Cash Flow Forecasting

Cash flow forecasting is the process of estimating future cash inflows and outflows over a specific period. It helps businesses anticipate financial challenges and make informed decisions. The steps involved in creating a cash flow forecast include:

- Analyzing historical cash flow trends.

- Estimating future sales and revenue.

- Projecting expenses based on anticipated changes.

Important factors to consider in forecasting include seasonal fluctuations, market trends, and changes in consumer behavior.

Managing Receivables and Payables, How to manage cash flow effectively

Effective management of accounts receivable is essential for maintaining healthy cash flow. This involves tracking customer payments and ensuring timely collections. Techniques for managing accounts payable can include:

- Setting clear payment terms with vendors.

- Employing efficient purchase order systems.

- Regularly reviewing supplier contracts for better terms.

Maintaining healthy customer relationships is key to ensuring timely payments and fostering loyalty.

Financial Planning and Budgeting

Financial planning plays a significant role in cash flow management by helping businesses set realistic financial goals and allocate resources efficiently. Creating a budget that aligns with cash flow objectives requires understanding fixed and variable costs. Monitoring budget adherence can involve:

- Regularly reviewing budget versus actual performance.

- Adjusting forecasts based on unexpected changes.

- Maintaining flexible budgets to accommodate fluctuations.

Dealing with Cash Flow Issues

Common cash flow problems businesses face include delayed customer payments, unexpected expenses, and seasonal fluctuations in sales. Solutions for overcoming cash flow crises could involve:

- Securing a line of credit for emergency funds.

- Implementing stricter credit policies for customers.

- Identifying less profitable products or services and adjusting accordingly.

Indicators that signal potential cash flow issues include consistently late payments, increased inventory levels, and declining sales.

Leveraging Financing Options

Various financing options are available for managing cash flow effectively. Short-term loans can provide immediate cash relief but come with their own advantages and disadvantages, such as interest rates and repayment terms. A comparative analysis of financing solutions can include:

- Bank loans versus alternative financing.

- Lines of credit versus invoice factoring.

- Peer-to-peer lending versus traditional lending institutions.

Understanding the impact of each option on cash flow is vital for making informed financial decisions.